cares act stimulus check tax implications

If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return. Check out our Stimulus Check Calculator.

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Up to 150000 if married and you filed a joint tax return.

. It is not clear at this time whether or to what extent states will conform to the provisions contained in the CARES Act. CARES Act Coronavirus Relief Fund frequently asked questions. But what are the tax implications for stimulus checks and unemployment benefits.

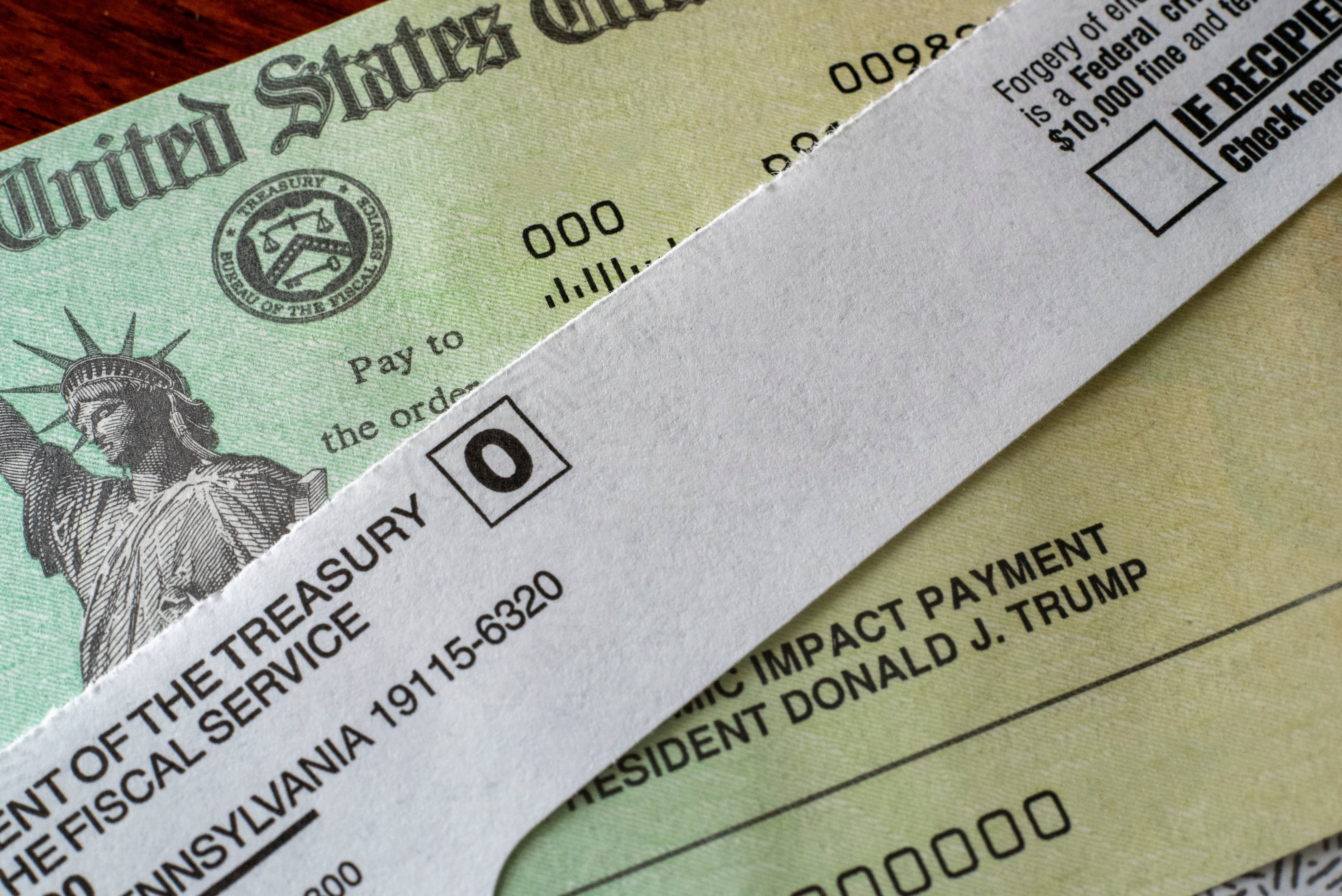

The CARES Act will provide many individuals with a recovery rebate known as a stimulus payment or stimulus check in the next few. The CARES Act may also have substantial state and local tax implications including the creation of additional refund opportunities related to previously filed returns or for 2019 returns that are currently being prepared. The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax.

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. An EIP2 payment 23 de jun. For married couples filing joint returns the income limit to receive a stimulus check is 150000.

Single filers who make more than 99000 and joint filers with income exceeding 198000 are not eligible for stimulus payments nor are those over 16 who are claimed as dependents by their parents which includes many college-aged people. Individual taxpayers will be receiving a 1200 paymentCouples will receive 2400If you have a qualifying child 16 and under each child will add an additional 500Once taxpayers reach an adjusted gross income threshold of 75000 150000 couple the refundable tax credit begins to phase out at a rate of 5 for every. The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for NOL deductions for tax years beginning before January 1 2021 ie it allows an NOL to fully offset taxable income in the temporary window which is the period of time beginning with the.

Here are four things to know about the CARES Act. The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for NOL deductions for tax years beginning before January 1 2021 ie it allows an NOL to fully offset taxable income in the. The threshold for married couples is 150000.

Up to 112500 if you filed as head of household. The CARES Act sends a 1200 stimulus check to eligible adults earning up to 75000. For individuals who itemize their tax.

Heres an example suggested by Garrett Watson senior policy analyst at the foundation of how a stimulus payment taken as a recovery rebate credit might affect tax liability in those states. CARES Act Provides Tax Incentives for Charitable Giving in 2020. Cares act stimulus check tax implications Friday March 18 2022 Edit.

The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and provide assistance to taxpayers and businesses affected. When the CARES ACT passed taxpayers were informed they would be receiving a stimulus payment of up to 1200 for single filers 2400 for joint filers plus an additional payment for those who had dependent children. 748 the Coronavirus Aid Relief and Economic Security Act the Act.

The payments will be 1200 per adult for those with adjusted gross incomes of up to 75000. Included in the Acts wide-ranging stimulus provisions are a number of considerations relevant to individual taxpayers including individual recovery rebates deductibility of charitable contributions and a one-time exclusion on employer repayment of. For individuals who itemize their tax returns lawmakers extended a provision that allowed individuals to deduct qualifying medical expenses that exceeded 75 of their adjusted gross income.

There are important tax-related provisions for individuals in the Coronavirus Aid Relief and Economic Security CARES Act Congresss unprecedented economic stimulus package that the. If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return. On March 25 2020 the Senate passed HR.

Here we outline 5 major tax implications that have stemmed from the new stimulus package. You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments.

Up to 75000 if single or you filed taxes married filing separately. The stimulus check details are as follows. Recent changes to the CARES Act resulting from the COVID-19 pandemic will have state and local tax implications for your business.

Federal Aid In 2022 No More Stimulus Checks In Sight Child Tax Credit Payments Expired Abc7 Chicago

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Qualified Disaster Distributions Vs Stimulus Checks What Are The Differences Marca

How College Students Can Get Stimulus Money The Washington Post

Who Qualifies For A 1 400 Stimulus Payment Under The House Bill

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Stimulus Check Update Some Americans Eligible For 1 400 Payment This Year

Iphone 12 Is Almost Here Which Means Now Is The Worst Time To Buy A New Iphone Iphone New Iphone Buy Iphone

Irs Has Finished Sending Round One And Two Stimulus Checks If You Didn T Receive Yours You Ll Need To Claim It On Your 2020 Tax Return

Your Third Stimulus Check Can Be Seized Here S What To Know Cnet

Nonresident Guide To Cares Act Stimulus Checks

Stimulus Checks Tax Returns 2021

Claim Missing Stimulus Money On Your Tax Return Asap Here S How Cnet

How Nonfilers Can Get Stimulus Checks Including Those Experiencing Homelessness Cnet

600 Second Stimulus Check Calculator Forbes Advisor

Can Expats Without A Us Bank Account Still Receive A Stimulus Payment Toma De Decisiones Seguridad En Uno Mismo Decisiones