does binance send tax forms canada

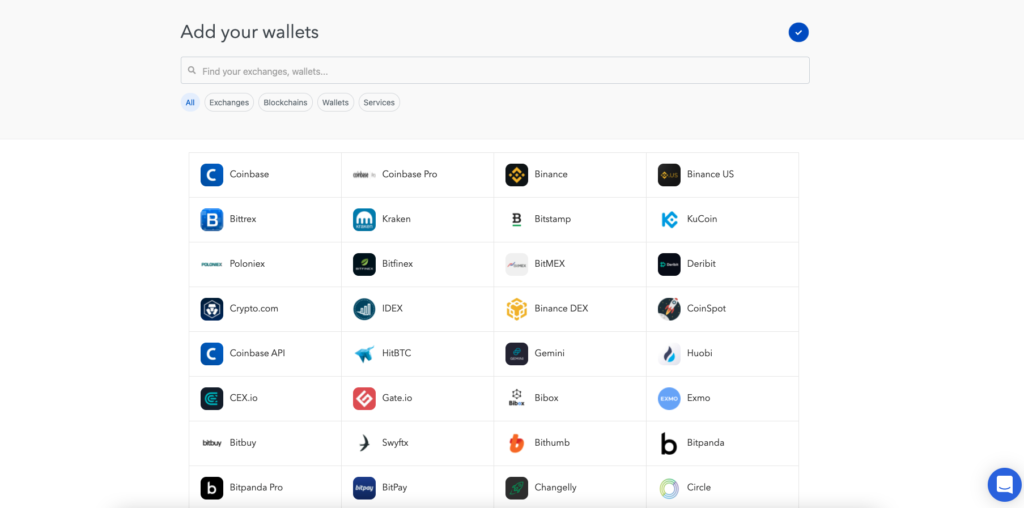

Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada. Upload your CSV or XLSX files here.

How To Buy Bitcoin In Canada Complete Beginner S Guide

If you earned at least 600 through staking or Learn and Earn rewards BinanceUS issues 1099-MISCs and reports to the IRS.

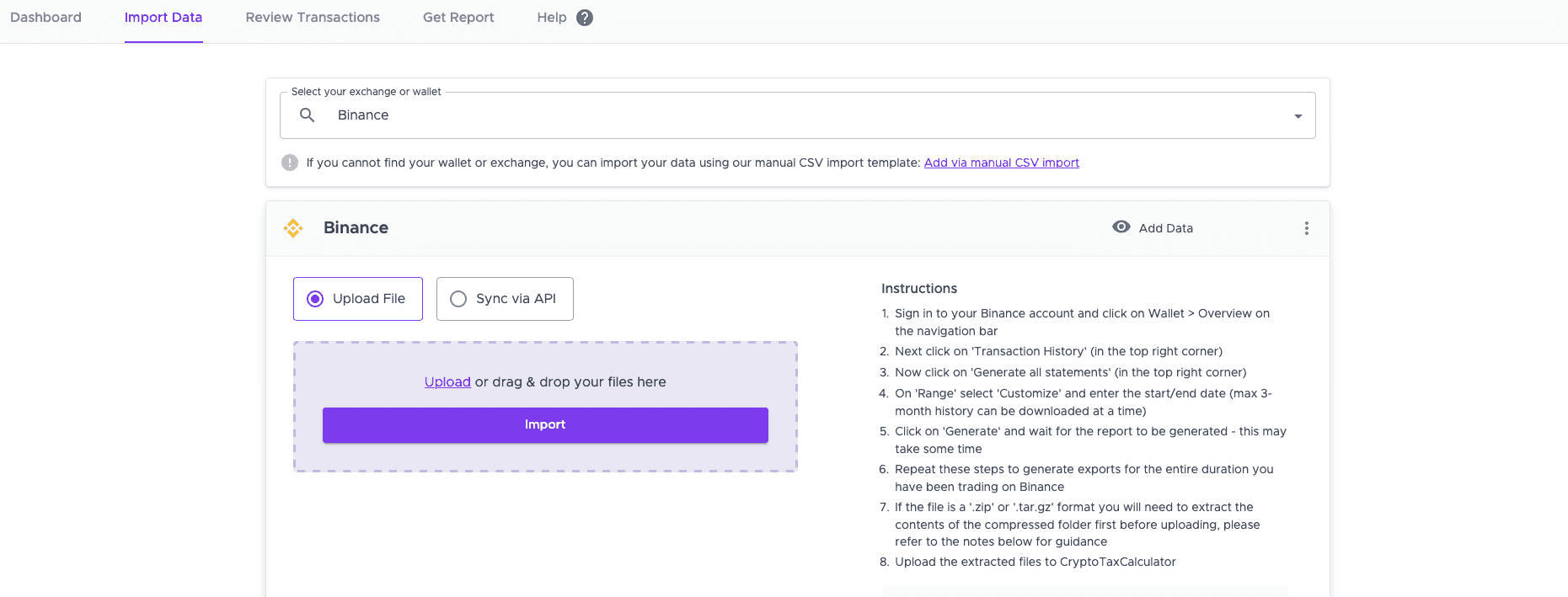

. If you have crypto transactions that qualify for capital gainloss this form should be completed and filed with your annual tax return. No Binance doesnt provide a specific Binance tax report - but it is partnered with a variety of excellent crypto tax apps like Koinly that can take your Binance transaction report and use it to generate a tax report for Binance. It can take up to several working days.

Only half your crypto gains are taxed. Yes Binance is legal in Canada except in Ontario. Also Binance is unavailable to those in Ontario and if this is you they would have asked you to close out your account by the end of 2021.

Report the resulting gain or loss as either business income or loss or a capital gain or loss. CoinSmart This top-tier Canadian trading platform supports 16 popular coins and charges competitive low trading fees. Form 1040 Schedule D This is a summary of capital gains and losses.

Be mindful that because Binance is outside of Canada you may be require to file a T1135 form with the Canada Revenue Agency. In Q1 2022 the Binance Chain one of the worlds most extensively utilized blockchains burned 1839786261 BNB the Blockchains native cryptocurrency valued around 742 million. Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards.

The new Tax Statements portal brings all of BinanceUS crypto tax. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct. As a result your cryptocurrency activity on Binance and other platforms is subject to capital gains and ordinary income tax.

If you dispose of your crypto-assets youll incur capital gains tax. Learn how the BinanceUS Tax Statements portal can help you access your transaction history and sync your crypto activity to trusted third party tax platforms. In this article well show you.

Thats how much youll pay tax on. These generally supplement Form 8949. These kinds of incomes are classified as ordinary income.

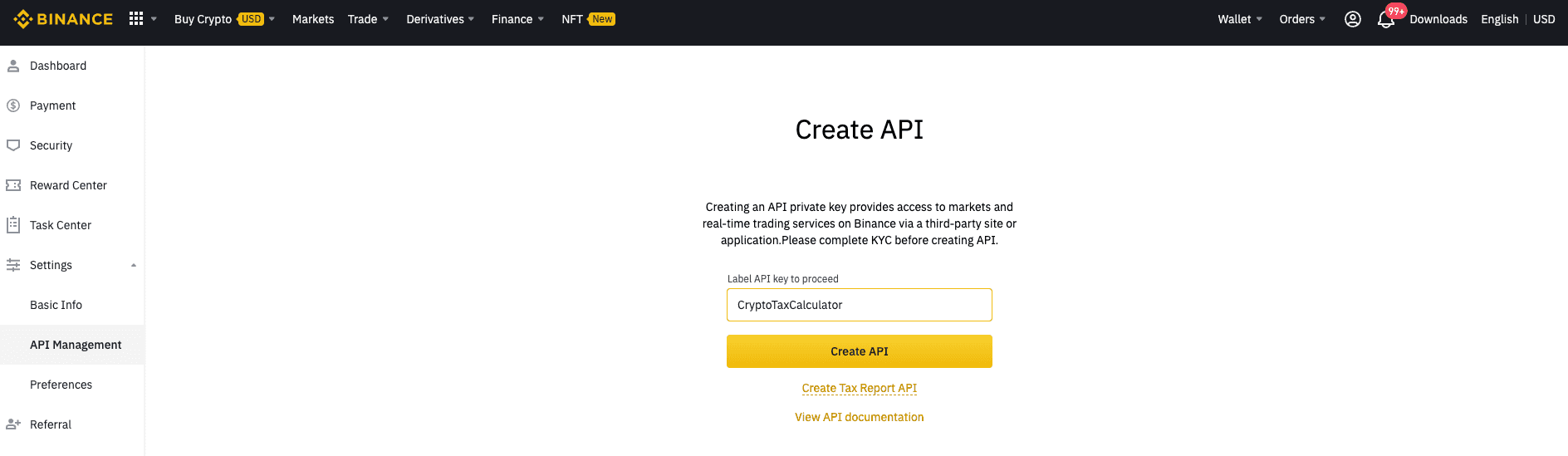

Yes Binance does provide tax info but you need to understand what this entails. Does Binance provide a tax report. Click Create Tax Report API.

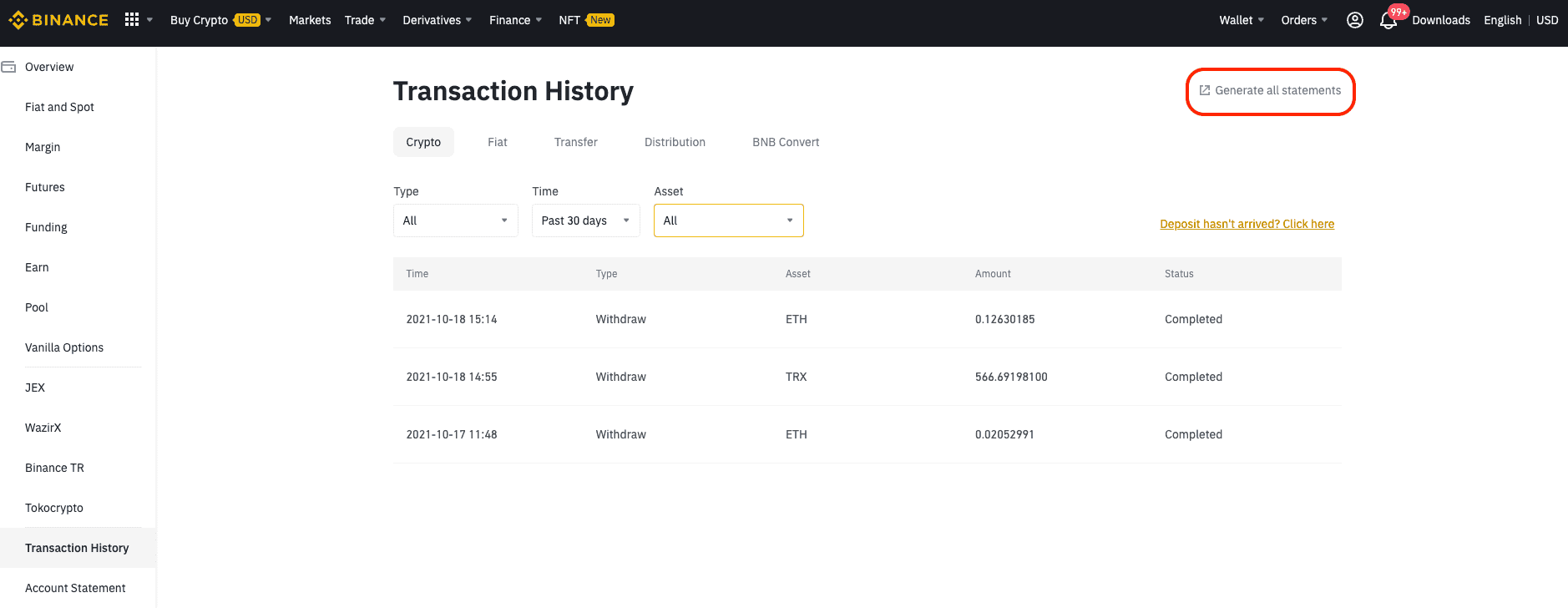

Binance allows exporting trades for a 3 month period at a time. Canada has a few tax breaks that crypto investors will be interested in. Please note that each user can only create one Tax Report API and the tax tool functionality only supports read access.

Then Does BinanceUS Issue 1099-MISCs and Report to the IRS. Log in to your Binance account and click Account - API Management. You can calculate this in a couple of different ways but the easiest way is to add up all your capital gains and then halve the amount.

Examples include selling your cryptocurrency for fiat or trading it for other cryptocurrencies. Youll only pay Capital Gains Tax on half your capital gains. By law the exchange needs to keep extensive records of every transaction that takes place on the platform.

Click on Export Complete Trade History at the top right corner. Fiat not crypto is taking longer than expected to arrive in your bank Binance account. Does Binance Give Tax Info.

You have to convert the value of the cryptocurrency you received into Canadian dollars. This is the 19th installment in Binance Chains quarterly token burn program which. Involves intermediaries such as bank transfers or buying crypto with creditdebit cards.

Binance Alternatives in Canada There are several crypto trading apps you can use in Ontario and the rest of Canada if you want to avoid the risks of Binance getting banned. At the time of writing as a Canadian you could open an account with Binance. Fiat deposit withdrawal.

Meaning you will need to import 4 files for every year of trading. Relevant Tax Forms Form 8949 This form is used to report sales and exchanges of capital assets. Binance Tax Reporting You can generate your gains losses and income tax reports from your Binance investing activity by connecting your account with CoinLedger.

This transaction is considered a disposition and you have to report it on your income tax return. Binance Chain burns 742 million worth of BNB in 19th quarterly burn. You will receive your unique API and Secret Key for Tax Report.

This transaction is considered a disposition and you have to report it on your income tax return.

Koinly Review Can Canadians Trust Crypto Taxes To Them Ocryptocanada

Koinly Review Can Canadians Trust Crypto Taxes To Them Ocryptocanada

Koinly Review Can Canadians Trust Crypto Taxes To Them Ocryptocanada

Implications Of Tax On Crypto Assets In India Binance Blog

How To Connect Binance And Koinly

Binance Us Review Pros Cons And More The Ascent By Motley Fool

Koinly Review Is It Really A Good Tax Software Coincodecap

How To Connect Binance And Koinly

How To Top Up Or Recharge My Binance Card Via The Funding Wallet Binance Support